Board Renewed: Lord Gregory Barker appointed as Chairman

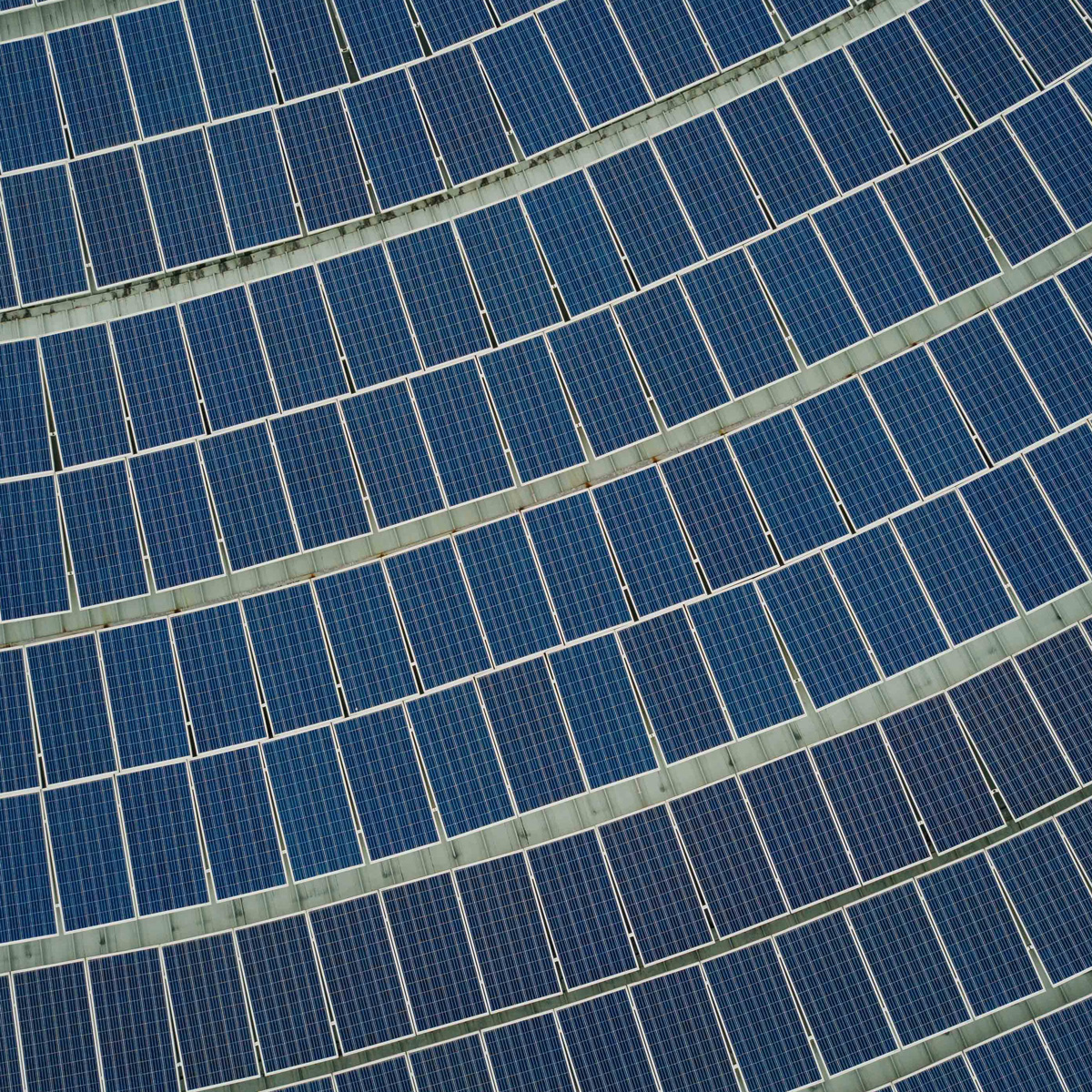

London, Milan, 1 October 2018. Quercus Group informs that a joint venture agreement was finalised during the summer with RF Capital, an Australian financial group active in several sectors, from construction to financial activities. A newco on a fifty-fifty basis is being set up. Quercus will be the industrial partner, mainly taking care of the renewable energy infrastructure investment and asset management activities; whereas RF Capital has committed to provide Eur 400 million over the next 4 years. Initially, investments will be in solar and wind power plants.

The two partners are setting the scene for a quick start to deploy capital on the initial investment opportunities. A first informal investment committee has already taken place in London recently and the activity is expected to start over the end of this year.

On Thursday 27 September the Annual General Meeting of the sole shareholder of Quercus Assets Selection Sarl has also been held. The shareholder is pleased to announce the approval of the 2017 year-end accounts of and the appointment of Quercus deputy chairman, the Rt Hon Lord Barker of Battle, (former UK Energy & Climate Change Minister), as new group chairman and the appointment to the board of Mr Christopher Knowles, as vice chairman. Mr Giulio Antonello has also been appointed as new member of the board.

Mr Knowles, was previously Head of Infrastructure Funds & Climate Action at the European Investment Bank (2006-2017). Mr Knowles is also a member of the OECD Centre for Green Finance and Investment, Advisory Council and chairs the Green for Growth Fund (South East Europe).

Mr Vito Gamberale (74) retires as chairman and leaves the board with the company’s warm thanks for his contribution to the group.

Mr Torkil Bentzen (72) also is stepping down and leaves the board with the company’s best wishes.

Commenting on the new appointments Lord Barker said: “I am delighted to step up to chair the group at such an exciting time in the development of Quercus. As the company grows, so the board is growing in strength and experience, as we look to build on our early success and identify new and sustainable opportunities for enhanced returns for our expanding investor base.”

Mr Knowles brings a wealth of experience in the European renewable energy market, where he helped create, across a range of renewable energy technologies, the new asset class that is driving Europe towards a genuinely low carbon economy.

Mr Giulio Antonello has a very distinguished track record in the Italian renewable energy sector and will bring huge insight and experience to our board discussions.

Diego Biasi, Co-Founder and CEO of Quercus also added: “Quercus is also pleased to announce its plans for the launch of a new UK fund dedicated to EV infrastructure: QEVI. This is a very exciting time for us and we are extremely pleased with the progress we have made so far in this market niche. QEVI will be an important part of our future strategy in the UK and international market”

About Quercus Assets Selection:

Founded by Diego Biasi, current CEO, and by Simone Borla inl 2010, it is one of the main European funds specialised in renewable energy. From when it was first launched, the fund has managed five different technology and investment policy strategies: from construction to M&A activities. It has an ongoing Joint Venture with the English government in the English biomass sector and with Swiss Life in the Italian photovoltaic market for large scale plants.